Third-Party vs Comprehensive Car Insurance: Which Type Actually Protects You Better?

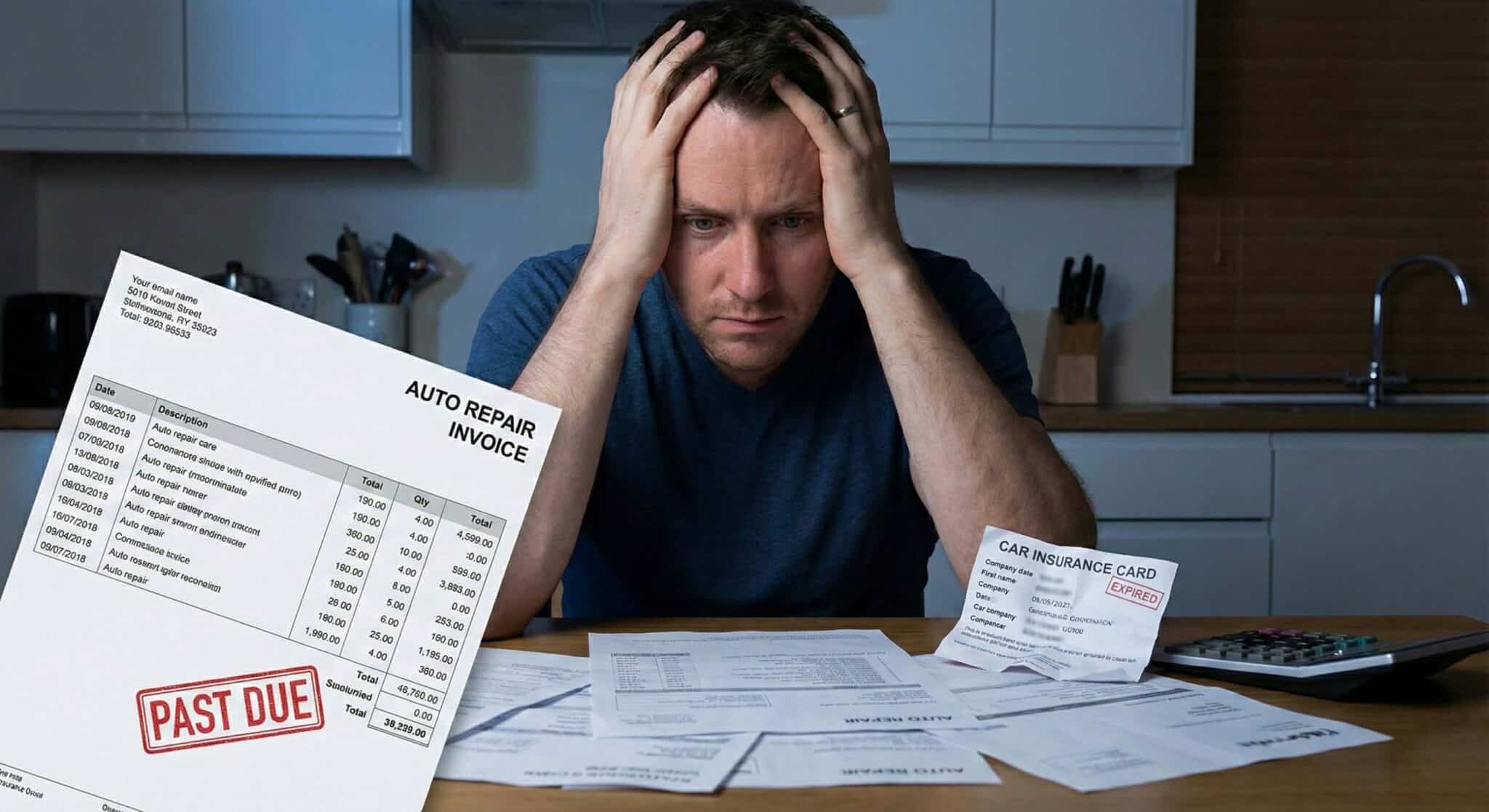

Many drivers renew their yearly policy without thinking much about what they are choosing. But the moment something goes wrong, the difference between coverage types becomes impossible to ignore. This is where the topic of third-party vs comprehensive car insurance becomes important. It shapes how much you pay, how much protection you receive, and how…