Many drivers renew their yearly policy without thinking much about what they are choosing. But the moment something goes wrong, the difference between coverage types becomes impossible to ignore. This is where the topic of third-party vs comprehensive car insurance becomes important. It shapes how much you pay, how much protection you receive, and how well you recover after an accident.

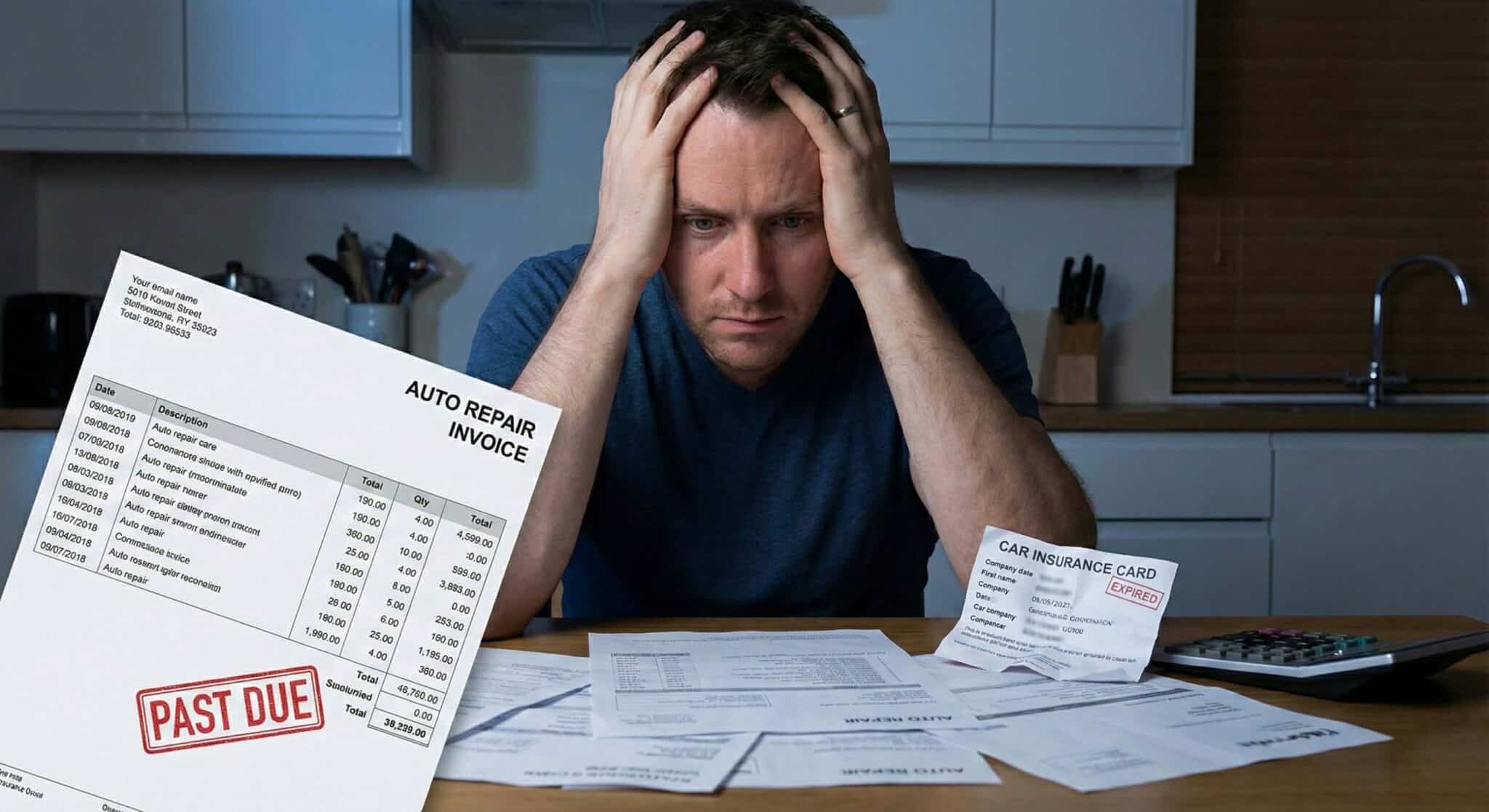

For most people, choosing the wrong insurance is not just a small mistake. The financial impact can last long after the accident is over. Vehicle repairs, medical treatment, and compensation claims have all become more expensive in recent years. Because of these rising costs, understanding your insurance options is now an essential part of protecting your money.

Why Third-Party vs Comprehensive Car Insurance Matters

Third-party insurance is the minimum legal requirement in many countries. It protects the people you harm, but not you. Comprehensive insurance covers everything third-party covers and adds protection for your own vehicle. Knowing the difference helps drivers avoid unexpected financial pressure.

Drivers who only choose based on price sometimes discover too late that their coverage is not enough. A basic policy is cheap at renewal time, but expensive when damage occurs.

What Third-Party Insurance Covers

Third-party insurance focuses on damage you cause to other people. It provides:

- Coverage for another driver’s car

- Compensation for injuries to other people

- Legal liability protection

But third-party insurance does not include:

- Your own vehicle repairs

- Your medical bills

- Theft or fire

- Flood or storm damage

- Hit-and-run incidents

These gaps create real financial risk for anyone who depends on their vehicle.

What Comprehensive Insurance Provides

Comprehensive insurance includes everything third-party offers plus a wide range of additional protection. This makes it far more suitable for modern vehicles.

- Your own car repairs

- Theft and vandalism

- Fire, storms, and floods

- Hit-and-run coverage

- Personal injury protection

- Third-party liability

Cars today contain electronics that make repairs significantly more expensive. Comprehensive coverage helps manage these rising costs.

Why Repair Costs Are Increasing

Modern vehicles are built with advanced systems such as radar sensors, cameras, blind spot detection, and lane assist modules. Replacing or recalibrating these parts is costly. Research from the Insurance Information Institute confirms that repair prices have increased worldwide due to technology and labour shortages.

This trend makes comprehensive insurance more valuable, especially for newer models.

Additional Risks That Third-Party Does Not Cover

Floods, heavy rain, fire outbreaks, and vehicle theft create major financial losses every year. Third-party insurance does not cover any of these situations. Comprehensive insurance protects you in all of them.

If you rely on your car for work or daily transport, the lack of protection can put significant pressure on your income and savings.

Legal and Financial Trouble With Weak Coverage

When your insurance is not strong enough to cover the damage you cause, you may be held responsible for the remaining cost. This can involve legal action, compensation payments, and long-term financial commitments. Strong insurance prevents these problems and gives you confidence while driving.

What Smart Drivers Choose

Drivers with older cars or low usage sometimes select third-party cover. But for anyone with a newer car, a long commute, or a high-risk environment, comprehensive insurance offers far better protection. It reduces stress, prevents unexpected expenses, and protects your financial future.

If you want to understand how financial systems handle risk in other areas, you can read this comparison between cryptocurrency and traditional banking. Both topics highlight the importance of choosing the right protection.

When comparing third-party vs comprehensive car insurance, comprehensive coverage protects you better in almost every real-world scenario. It is the safer and more reliable choice for most drivers.